Revealed: 60% of the Biggest Hedge Funds Hold Bitcoin, Disclosures Show

The crypto market is in a state of flux for now, with some altcoins sky-rocketing while others are enduring a tough month at the office.Revealed: 60% of the Biggest Hedge Funds Hold Bitcoin, Disclosures Show

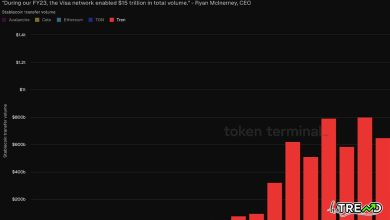

Although retail enthusiasm is subdued, the introduction of spot Bitcoin ETFs has breathed life into institutional interest in the industry.

Of the top 25 hedge funds, over half have some exposure to Bitcoin via these exchange-traded products.

The biggest holder, Millennium Management, owns more than US $1b in BTC on behalf of its clients.

Meanwhile, Goldman Sachs have also entered the scene after going on a buying spree in Q2 2024.

The topsy-turvy economic conditions of the past month have not deterred hedge funds from investing in crypto. According to holdings reports from the top 25 hedge funds (by assets under management), more than half of the firms hold BTC – via the wrapper of an ETF.

You can read more Crypto articles

The news comes as interest in spot Bitcoin funds continues to grow, despite weaker performance from most of the crypto market.

Biggest Hedge Fund Holder of BTC Owns Over AU $2b of the Asset

Institutional interest in Bitcoin has been consistent throughout 2024, even as the average retail investor mostly watches on from the sidelines. Massive financial companies like BlackRock, Franklin Templeton and even crypto-haters JPMorgan have invested (or released) spot Bitcoin ETFs throughout the year.

Now, massive hedge funds such as G.S. Asset Mgmt and Schonfeld are joining them.

Of the top 25 hedge funds, Millennium Mgmt. is currently the biggest holder, with the institution adding 1,429 BTC throughout Q2 2024. This brings its total to an impressive 27,263 BTC, currently valued at approximately US $1.6b (AUD $2.3b).

Goldman Sachs and Schonfeld Huge Players in Q2 2024

Of the new entrants to the Bitcoin ETF scene, Schonfeld Strategic Advisors were the most active in 2024’s second quarter. The US $14b (AU $20.76b) company purchased the equivalent of 6,734 BTC in this timeframe. This immediately made them the second-biggest holder of BTC among the top 25 hedge funds, behind only Millennium Management.Revealed: 60% of the Biggest Hedge Funds Hold Bitcoin, Disclosures Show

G.S. Asset Management was also prolific over the last quarter. Goldman Sachs, who hold a whopping $2.8t (AU $4.1t) AUM, dove into cryptocurrency by snapping up over US $400m (AU $593m) of Bitcoin ETFs.

The data demonstrates that retail’s hesitancy to re-enter the crypto landscape is largely one-sided and new, sustainable growth among the industry is being driven by institutional giants with deep pockets.

Follow HiTrend on X